Institution: EIB

European Investment Bank energy investments 2002-2006

Briefing | September 26, 2007

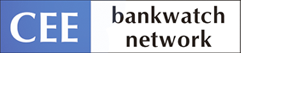

A database of the EIB's investments in the energy sector from 2002-2006, compiled from the EIB's annual reports, shows that most of its investments in this sector went to gas as well as electricity distribution.

(For an analysis covering the years until 2008, please see our study Change the lending, not the climate.)

Out of total energy investments of EUR 23.7 billion during this period, EUR 11.3 billion went for fossil fuels, while only between EUR 3.0 and 3.6 billion went for renewable energy depending on whether hydropower is included as renewable. Apart from one or two specific projects, energy efficiency investments are impossible to quantify as they are mainstreamed into other projects.

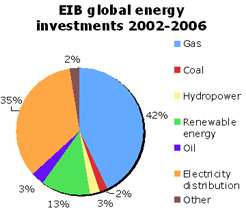

Putting aside investments into electricity distribution starkly illustrates the overwhelming priority being given to gas investments by the EIB and shows for the 2002-2006 period that 76 percent of investments into specific energy sources have gone to fossil fuels.

Bankwatch's examination of the EIB's energy investments in the first eight months of 2007 does however reveal some promising statistics: in absolute terms, lending for renewables has increased from a 2002-2006 average of 596.2 million to around EUR 960 million excluding hydropower, and is so far making up 27 percent of the EIB's energy investments this year.

However, the bank has still loaned over EUR 1.2 billion for gas to date this year, undermining the benefits of the renewables investments. In addition, in 2007 the EIB has supported a carbon credit fund with German bank KfW, and has expressed its interest in financing nuclear energy, both of which are considered by many observers to be dangerous distractions from addressing climate change.

For a short summary on each project, please see the database of EIB energy projects 2002-2006.